Foreign Real Estate Investor Tax Planning Techniques: PART 1 (Advanced)

Income Tax

Non Resident Alien Individuals and Foreign Corporations (“Foreign Investors”) that invest in U.S. real estate are taxed similar to U.S. Individual Taxpayers and U.S. Corporations on their U.S. real estate income. We will use the term “Foreign Investors” for foreign individual(s) and foreign entities.

The similarities are that Foreign Investors in U.S. real estate will be taxed on their ordinary income, whether it is from operating income such as rentals or inventory sales or other income producing transaction from U.S. real estate. Foreign Individual Investors, like American individuals will be taxed on their capital gains from the sale of investment real estate at lower tax rates than ordinary income.

Foreign Corporations, like U.S. Corporations, have the same rate of tax imposed on capital gains and operating income

Estate and Gift Tax

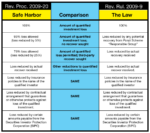

There is a drastic difference between the U.S. estate and gift tax laws that govern U.S. persons and Non Resident Individuals who may die owning U.S. real estate, or foreign individual investors who give gifts of U.S. real estate to third parties. The U.S. gift taxes and estate taxes on Foreign Investor(s) are prohibitive and can be as high as 40% of the net value of the real property gifted or demised. Only a small amount of the value of the real estate, ($60,000), may be a gift or left as an inheritance during the Foreign Investor’s life without paying U.S. estate or gift taxes.

However, the U.S. estate and gift taxes can be avoided.

Branch Tax

There is also a unique tax on Foreign Corporations that build cash reserves from earnings and profits in the U.S. They must either reinvest cash in U.S. assets, or distribute the cash as dividends or suffer a tax known as “Branch Tax”. This can be an additional 30% tax on profits in addition to the foreign corporate income tax.

The Branch Tax is another tax that can be planned around.

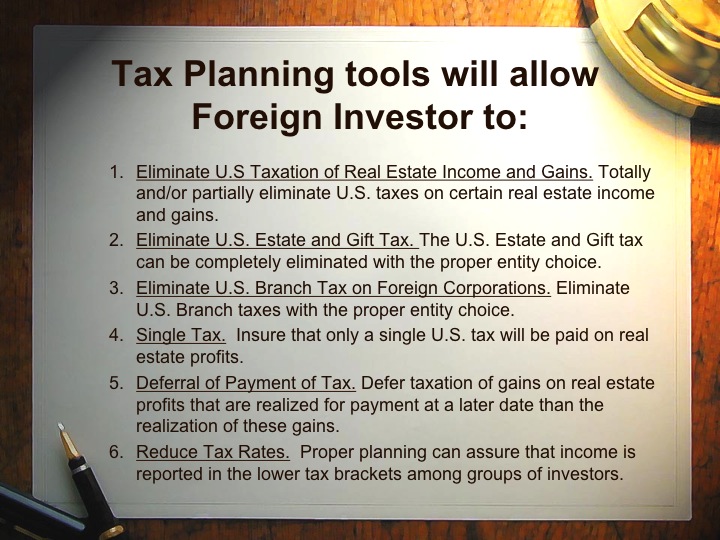

Foreign Investor – Tax Benefits

Because of the laws that favor foreign investments in the United States; and because of certain advantages that a Foreign Investor may find if a U.S. Tax Treaty governs the Foreign Investors, there can be significant differences and benefits for Foreign Investors in U.S. real estate; many of which are not enjoyed by American Investors.

In PART 2 Richard S. Lehman will discuss many Foreign Investor Tax Planning Tools