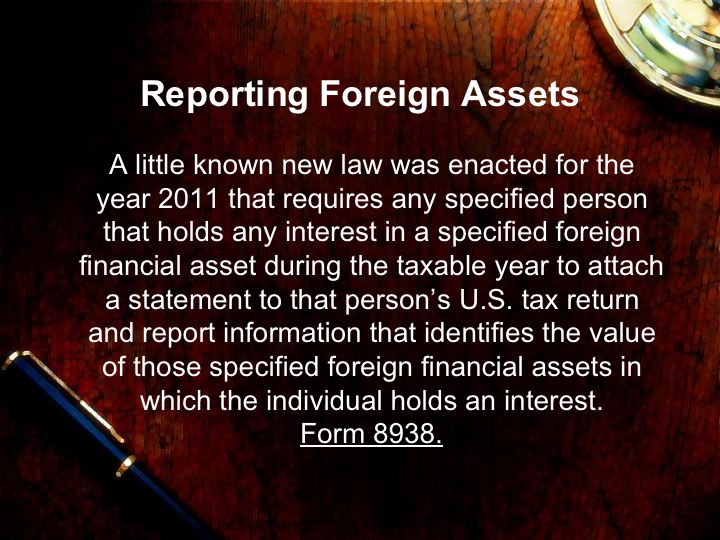

United States taxpayers, last opportunity if you have unreported bank deposit income or income from certain tangible foreign assets

U.S. taxpayers living overseas need not fear reporting foreign income If an American Taxpayer living outside the United States is concerned that his or her failure to report income, pay tax and submit required information returns was due to willful …