Upcoming Tax Webinars with Richard S. Lehman

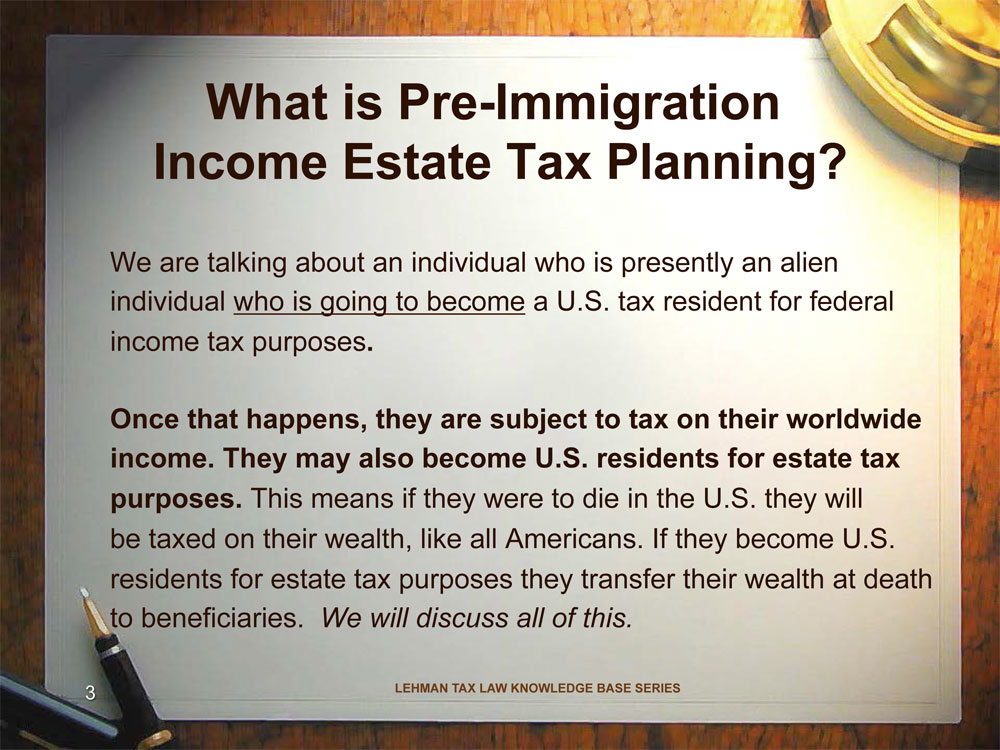

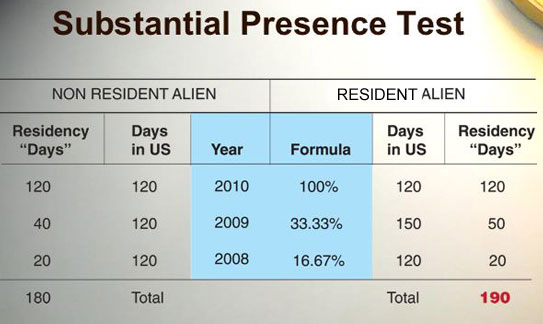

United States Tax Attorney, Richard S. Lehman presents these webinars live. They are all accredited webinars and they are free. Participants must register in advance of the webinar to receive credit. All Upcoming Webinars 2019-2020: United States Taxation Topic Duration …