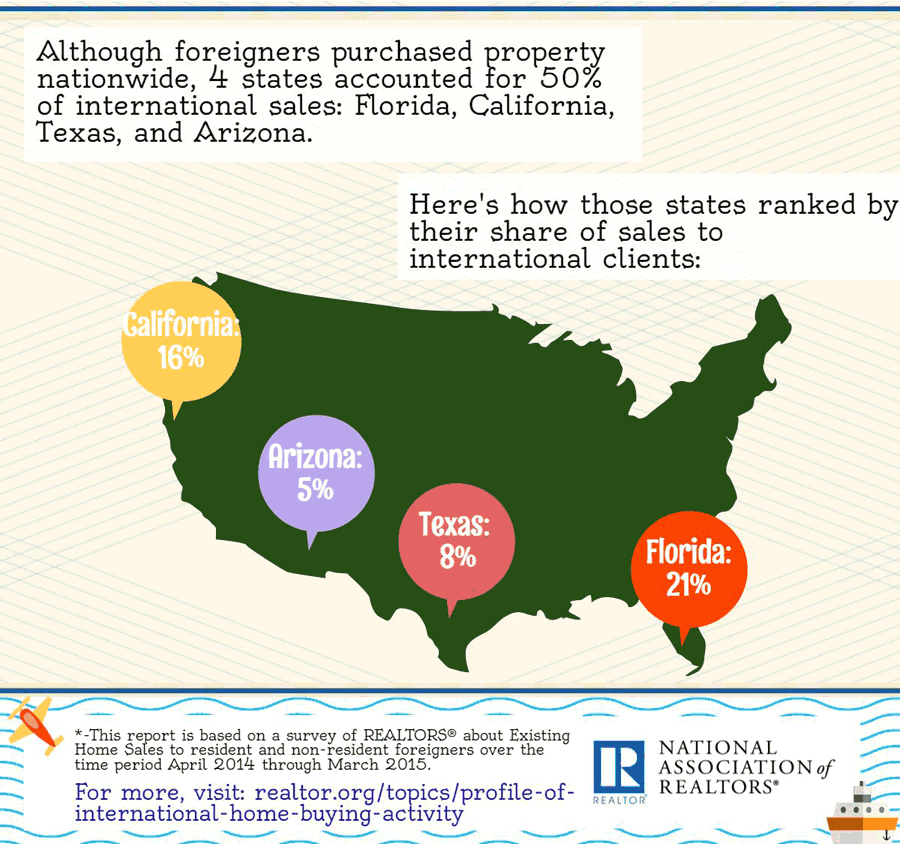

Thinking of buying real estate in Florida, California, Texas, or Arizona?

The United States is a secure and attractive location for foreign investments and owning property. For residential, investment, or for vacation purposes many advantages exist for the foreign investor in United States real estate. In June 2015, the National Association …

Thinking of buying real estate in Florida, California, Texas, or Arizona? Read more »