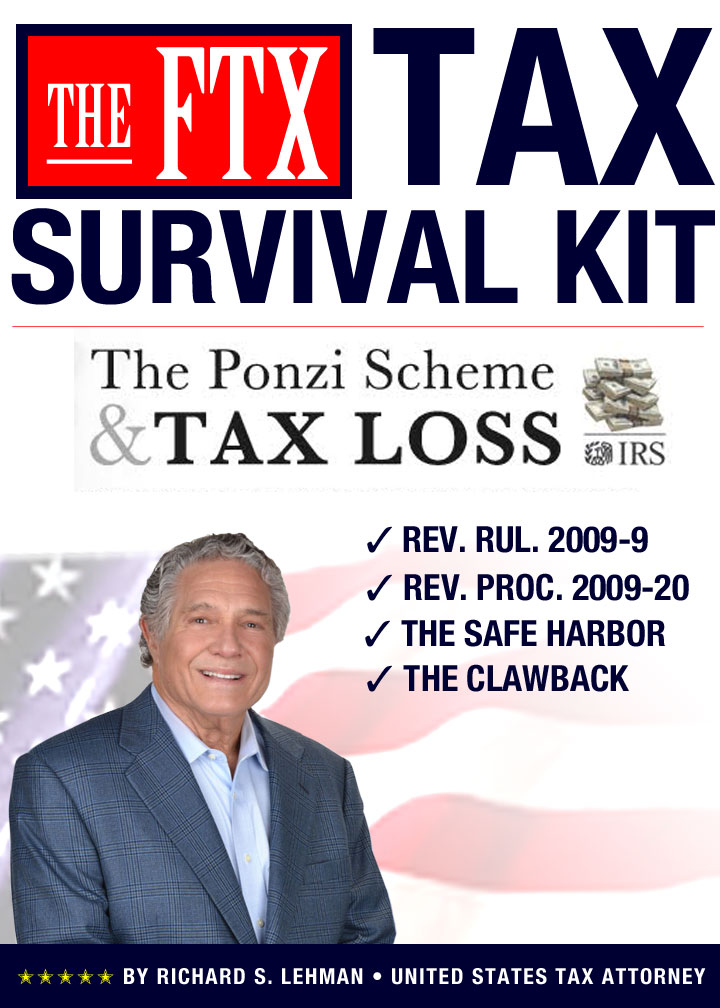

FTX Tax Survival Kit

For Those Who Lost Money:

Everyone that paid taxes on nonexistent profits will recoup those taxes from the I.R.S. Reports 1-3 below will explain in detail.

Report No. 1: FTX and Sam Bankman-Fried Fraud

The following is Report No. 1 in what is intended to be a series of reports focusing on the tax benefits available as a result of the FTX fraud. Each taxpayer has their own unique factual situation which is going to need to be reviewed by tax advisors and litigation counsel before any legal conclusions can be reached. The Reports are being made in a series form since there is still a great deal of facts to be uncovered in the FTX fraud. These facts are going to be extremely important in coming to conclusions about tax positions.

Furthermore, there could be guidance from the I.R.S. in this particular situation or any number of other factors that require the subject matter to be updated on a continual basis. The FTX fraud has resulted in much pain throughout the world. Hopefully some of this can be eased in the form of tax relief from either the U.S. or other countries whose citizens are entitled to permit their financial losses to be deducted from their taxes. REPORT NO. 1: Download 10 page pdf here. or read it online here.

Report No. 2: The Reasonable Prospect Of Recovery

There is no set of fixed rules that clearly define the taxpayer’s reasonable prospect of a recovery, that will result in a limitation of a taxpayer’s theft loss deduction in the year of discovery. However, it is possible to have a grasp of the concept by reviewing court statements defining the concept. We will also look at general principles that have emerged from the court cases and review two cases that could be said to represent the extreme ends of the spectrum of just what is a reasonable prospect of recovery. REPORT NO. 2: Download 10 page pdf or read it online here.

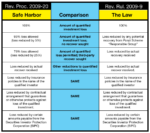

Report No. 3: The Safe Harbor

In 2009, two important documents were issued by the IRS regarding the taxation of Ponzi schemes. In the Rev. Rul. 2009-9, the IRS clarified much of the previously unsettled law in this area. The Rev. Proc. 2009-20 applies to losses for which the discovery year is a taxable year beginning after December 31, 2007; it offers thousands of Ponzi scheme victims a badly needed uncomplicated shortcut to cash refunds from tax losses. These two IRS documents form a good package and were drafted in record time, for any government agency. REPORT NO. 3: Download 8 page pdf here or read it online here.

— I.R.S Documents —

- I.R.S. Revenue Ruling 2009-9: Download the pdf here.

- I.R.S. Revenue Procedure 2009-20: Download the pdf here.

— Ponzi Scheme Information —

- VIDEO: Tax Refunds From Ponzi Scheme Losses: Watch this 50-minute educational presentation. Tax refunds from Ponzi Scheme losses are extremely valuable. https://www.lehmantaxlaw.com/tax-refunds-from-ponzi-scheme-losses/

- PRESENTATION SLIDES: Download as a pdf, 96 slides, a presentation for CPA’s and Lawyers; Ponzi Scheme Tax Loss and The Taxation of the Clawback. Download presentation here.

- ARTICLE: Ponzi Scheme Tax Losses, BNA Tax and Accounting Center, BNA 1-24-11, PDF

This BNA article is from 2011 and does not represent the updated Trump tax plan, yet contains vital important Ponzi material. Download pdf article here.

For Those Who Made Money:

If you are in the process of paying back your profits – the law is structured where you can get a tax refund. The amount depends on your tax bracket.

— Clawback Information —

- VIDEO: Taxation Of Ponzi Clawbacks: Clawback in a Ponzi Scheme – Maximum Tax Recovery, Watch this 50-minute educational presentation: The Ponzi Scheme Clawback. https://www.lehmantaxlaw.com/taxation-of-ponzi-clawbacks/

- ARTICLE: Favorable Tax Consequences Related to Ponzi Scheme and the Clawback,

BNA 9-19-11, PDF https://www.lehmantaxlaw.com/pdf/BNA_9_2011.pdf.

- Government Accountability Office (GAO): 80 pager; The Report to Congressional Requesters: Customer Outcomes in the Madoff Liquidation Proceedings. Download the 80 page pdf here.

This information is shared from Richard S. Lehman’s corporate website in the United States: Lehmantaxlaw.com/ftx

Contact Richard S. Lehman Today: