Located in the Dorot & Bensimon P.L. Domestic & International Tax Law Office

2000 Glades Road, Suite 312

Boca Raton, FL. 33431

Tel: 561-368-1113

Email: rlehman@lehmantaxlaw.com

Skype: LehmanTaxLaw

NEW LOCATION 11/18/21:

Located in the Dorot & Bensimon P.L. Domestic & International Tax Law Office

2000 Glades Road, Suite 312

Boca Raton, FL. 33431

Tel: 561-368-1113

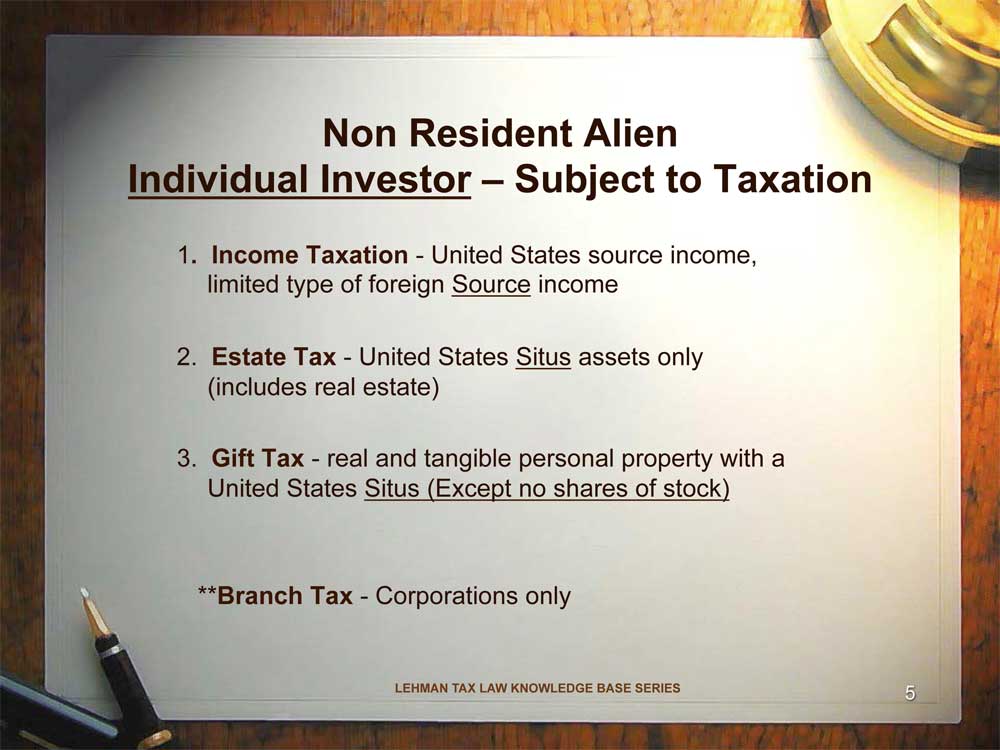

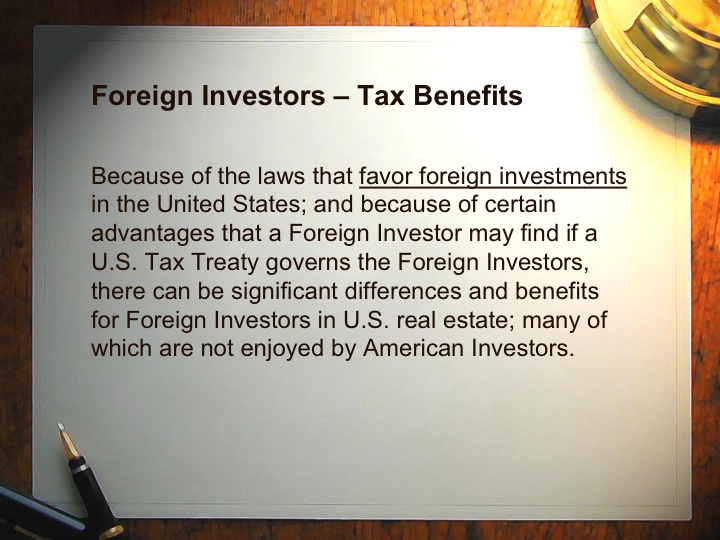

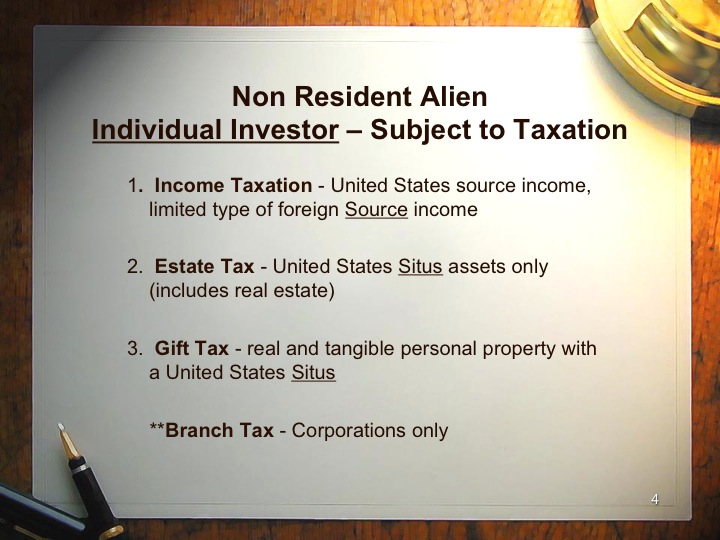

Email: rlehman@lehmantaxlaw.com The U.S. invites foreign investment of all types and offers tax incentives to the Foreign Investor.

We are committed to protecting your privacy

To provide communication security over the internet we have secured

inquiry pages with SSL.The information you enter on our site is held in the confidence between you and us. We do not sell, trade, or rent your personal information to others.

ebooks from Amazon by Tax Attorney Richard S. Lehman