United States Taxation of Foreign Investors – A General Overview

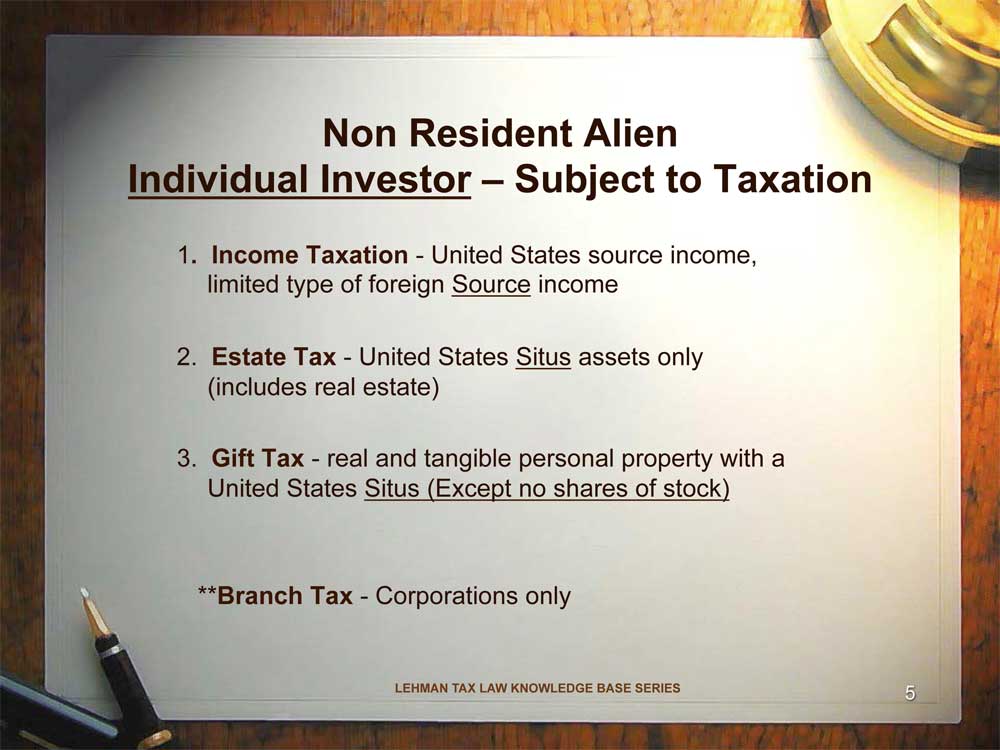

Foreign investors are prevalent in the United States in almost every form of investment; buying companies in the United States trading and selling goods in the United States and operating subsidiary businesses. The foreign investors’ tax in the United States is generally similar to the taxation of the American taxpayer, with several unique exceptions that become traps for the unwary foreign investors.

This presentation will consider many of the traps and techniques for success when foreigners invest in the United States.

Learning Objectives:

- Explore the alternative U.S. tax patterns available to the foreign investor.

- Identify the positive and negative aspects of tax planning techniques for the foreign investor.

- Discover the legal methods of tax planning for United States income tax purposes.

- Recognize the possible needs for planning for United States estate taxes.

- Learn about the numerous opportunities in American commerce.