U.S. Capital Gains Tax For Foreign Investors

When we talk about foreign investors non-resident alien individuals and foreign corporations both of whom are considered to be foreign investors. They invest in United States real estate and are tax similar to U.S. individuals and U.S. corporations on their U.S. real estate income.

At the same time they’re also taxed slightly differently and do have advantages to some extent over United States taxpayers. The term foreign individual investors is used for foreign individuals and foreign entities, trusts, partnerships, corporations any way that people can figure on how to get into the United States and invest.

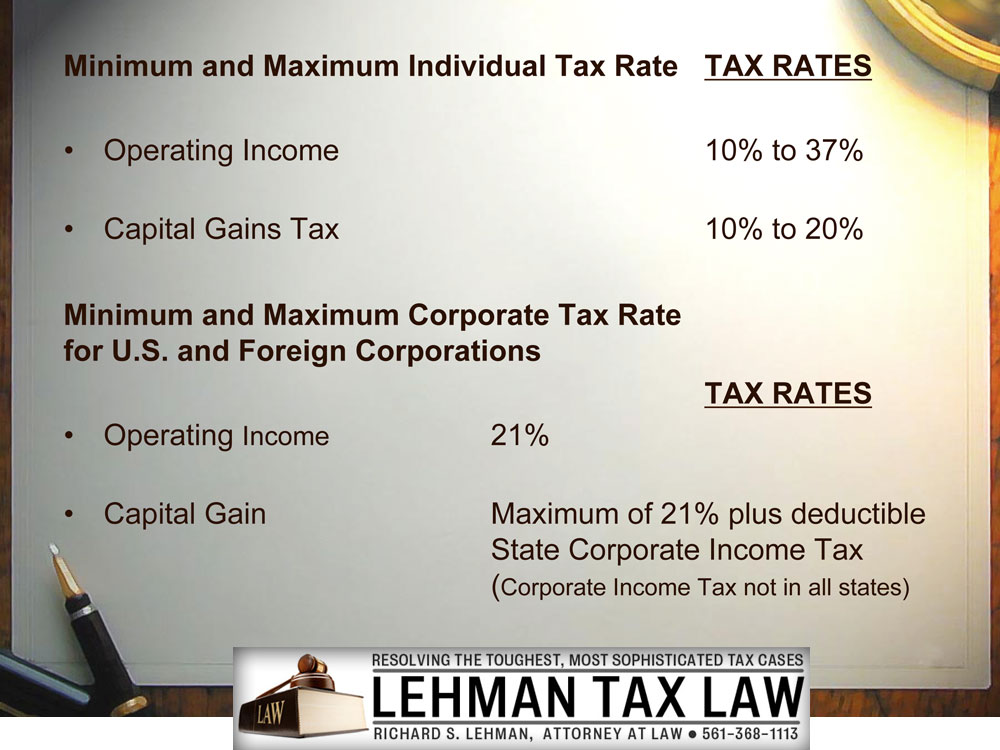

Foreign investors will be taxed on their ordinary income whether it’s from operating income or as rentals or inventory sales or other income producing transactions from real estate.

They will like an American individuals be taxed on their capital gains – from the sale of their investments that often are at lower tax rates than ordinary income.

Foreign corporations are taxed like U.S. corporations. They have the same rate of tax imposed on capital gains and operating income which under the new Trump tax bill is now a 21% tax.

There is also not just income tax and capital gains tax that foreign investors have to be concerned about. They need to be concerned about the estate and gift tax.

The United States allows its own citizens to leave millions and millions of dollars without paying a tax on the wealth that they are transferring. The United States does not assert taxes on foreign investors except where there is some relationship with the United States like real estate. Foreign investors may come to the United States and pay tax only on their real estate and not on any of their other income.

The problem with foreign investors and the estate and gift tax which is a death tax it’s a tax on the amount of wealth that is being transferred from parent to child. The amount of gifts that are being made. And it applies to transfers on U.S. real estate assets.

Frequenty Asked Questions

Taxation of Foreign Investors – General Overview

1. A nonresident alien individual may become a U.S. taxpayer by becoming a resident due to the “Substantial Presence Test” which requires the nonresident alien to spend more than 182 days in the United States in any single year. This is based upon a 3-year standard that measures the amount of days.

Correct Answer: True. A nonresident alien individual may become a U.S. taxpayer by becoming a resident due to the “Substantial Presence Test” which requires the nonresident alien to spend more than 182 days in the United States in any single year.

2. A nonresident alien may gift shares of stock in a United States corporation that owns U.S. real estate without the nonresident alien individual incurring a United States gift tax.

Correct Answer: True. A nonresident alien may gift shares in a U.S. corporation without incurring a gift tax during life.

3. A nonresident alien individual who dies owning shares of stock in a U.S. corporation that owns U.S. real estate will not be responsible for a U.S. estate tax on the value of those shares if they exceed the amount of Sixty Thousand Dollars ($60,000).

Correct Answer: False. Shares of stock in a U.S. corporation that directly own U.S. real estate are taxed under the U.S. estate tax rules with only a $60,000 exclusion before taxes must be paid.

4. A foreign investor (either a nonresident alien individual or a foreign corporation) may elect to defer taxes or gain in their U.S. real estate investments by choosing to do a “like kind exchange” on their real property for other real property located in the United States.

Correct Answer: True. The foreign individual investor and the foreign corporation, or any foreign entity that owns U.S. real estate will be permitted to take advantage of the Like Kind Exchange that assures there is no taxable gain on U.S. real property exchanged in the transaction.

5. A foreign investor that owns 10.5% of a U.S. corporation that owns U.S. real estate may lend money to that corporation and will not be responsible for any taxes on the interest income payable by the U.S. 30% corporate borrower to the Shareholder (lender).

Correct Answer: False.

Frequenty Asked Questions

Tax Planning Techniques For The Foreign Real Estate Investor

1. May a Foreign Investor invest in a corporation and avoid paying corporate and individual tax on the gain from the sale of U.S. real estate?

Correct Answer: Yes, once a corporation, Foreign or U.S., has sold all of its U.S. real estate holding and paid the single tax at the operating level of the corporation, the corporation may liquidate and distribute its assets to its foreign shareholders free of tax.

Learning Objective 1. To confirm that a foreign real estate investor may invest in U.S. real estate in the corporate form and pay only a single tax.

2. Can an Investor invest in U.S. real estate and pay no U.S. tax when the U.S. real estate is sold.

Correct Answer: Yes, there is a unique aspect to the U.S. tax laws when it comes to investing in U.S. real estate. If a foreign corporation invests directly in United States real estate and if the foreign shareholder can sell the shares of his or her foreign corporate stock to a buyer instead of the real estate, the shares of that Foreign Corporation that owns U.S. real estate directly can be sold by the Foreign Investor for no tax whatsoever.

Learning Objective 2. Confirm that sale of shares by a foreign investor in a foreign corporation is tax free.

3. Will a foreign investor be permitted to deduct a depreciation allowance (like U.S. taxpayers) from rental income earned from United States real estate investments?

Correct Answer: Yes

Learning Objective 3. To confirm that a foreign investor will be entitled to take advantage of a deduction for depreciation from U.S. rental real estate.

4. Will a foreign individual investor that invests in U.S. real estate be permitted to own a U.S. limited liability company as the investment entity that will own the U.S. real estate?

Correct Answer: Yes

Learning Objective 4. To confirm that a foreign investor may own U.S. real estate through a U.S. limited liability company as an acceptable investment entity.

5. What is the maximum Federal U.S. estate tax rate that can be applied if a foreign investor dies owning a foreign corporation that invests in U.S. real estate and earns less than $10.0 Million in U.S. income?

Correct Answer: 5. 0%

Learning Objective 5. To confirm that there is no U.S. estate tax when a foreign investor passes away owning shares in a foreign corporation.

Glossary

General Overview of Foreign Investors in the U.S.

- Nonresident Alien: The tax status of a foreign investor who is subject to the tax rules that govern foreigners and non-Americans

- Foreign Corporation: A corporation organized outside of the United States

- Foreign Investor –Passive Income: Income that is usually earned strictly on financial investments that involves no activity by the investors, such as interest, dividends and royalties.

- Foreign Investor – Active: Income that results from an active trade or business income business by a foreigner in the U.S.

- Branch Tax: A special tax only on foreign corporations that earn income in the United States

- Individual Ownership: An entity used by a foreign investor to Investment Entity do business as an individual taxpayer In the U.S.

- U.S. Corporation: A U.S. corporation that invests in the Investment Entity the U.S.

- Tiered Corporation: A corporate investment structure that consists of a foreign corporation that owns a 100% interest in a U.S. corporation and the U.S. corporation invests in a U.S. asset

- Closer Connection: An exception to permit foreign investors Exception to stay in the U.S. for a longer period before becoming U.S. taxpayers

- Portfolio Loan: A type of loan made by a foreign’ corporation or individual to a U.S.person or entity that results in no U.S. taxation on the interest income paid to the lender

- Like Kind Exchange: A type of real estate transaction that permits an investor to replace one real estate investment with another and pay no immediate tax on the asset being exchanged

Glossary

Foreign Investors in U.S. Real Estate

- Limited Personal and Asset Liability: Techniques to insure that investors are not sued Personally for investments.

- Double Taxation: Taxation on two countries “on the same income”

- Confidentiality: Techniques to insure that foreign Investors’ names are not disclosed as owners of assets

- Eliminate U.S. estate and gift taxes: The technique that insures nonresidents will not pay any estate or gift taxes in the U.S.

- Eliminate U.S. Branch Tax: Technique that insures the Branch Tax is not incurred by foreign corporate investors. The branch tax is a tax on foreign corporations with cash earnings that are not reinvested and held in the foreign corporation

- The Foreign Trust: A trust organized outside of the U.S. that may be used as an Investment vehicle in the U.S.

- Avoidance of Double Tax: Techniques that can be employed to insure there is only a single tax on real estate earnings. Limited

- Liability Company: A company that can be formed as a corporation or a partnership where the individual owners are taxed directly if it is treated as a partnership and not a corporation.

- Entity Choice: An array of investment vehicles carefully chosen to fit the investment for the minimum taxes

- Tiered corporation: A corporate structure with multiple layers of corporations to fit a tax need

- Liquidation of Corporation: Elimination of a corporation (often for tax purposes) when a corporation outlives its usefulness

- Residency for Estate Tax Purposes: Residency for estate tax purposes is a foreign taxpayer who became a U.S. tax resident for estate tax purposes only. This is a result of staying in the United States for a relatively long time and not intending to return to his or her home country