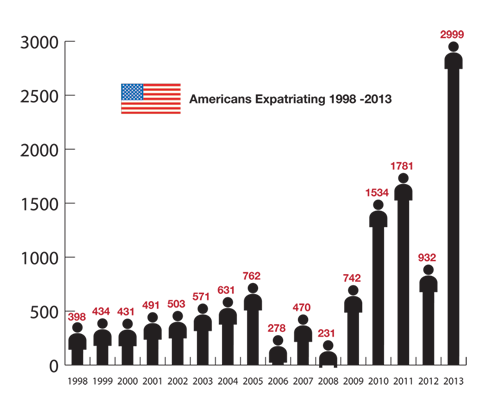

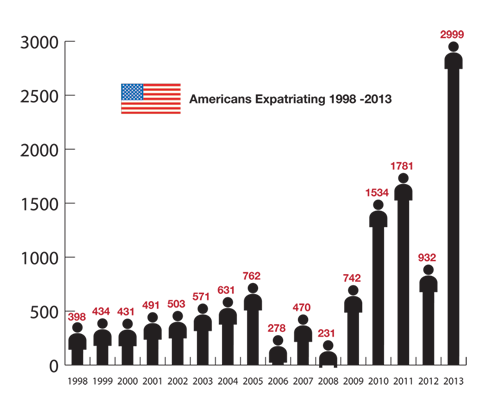

The Tax Planning for Expatriation from the United States

The taxation of Americans and long term green card holders (permanent residents) who expatriate from the United States has gone through many changes over the years. The latest version of these changes with tax expatriating Americans on their accumulated un-taxed wealth prior to their leaving the United States, along with their earned income that has not been paid and will be paid in the future.

In addition, the United States tax laws will tax expatriating Americans at draconian rates, for Americans that die owning United States wealth (the “Estate Tax”) and that make significant gifts (the “Gift Tax”) after they have given up their United States citizenship.