PODCAST: Pre-Immigration Tax and U.S. Investment Planning for High Net Worth Individuals

Navigating the EB-5 Investor’s Visa Program, Leveraging Tax Credits and Avoiding Tax Traps

This is a recording of a 90-minute webinar with Q&A

Podcast OUTLINE

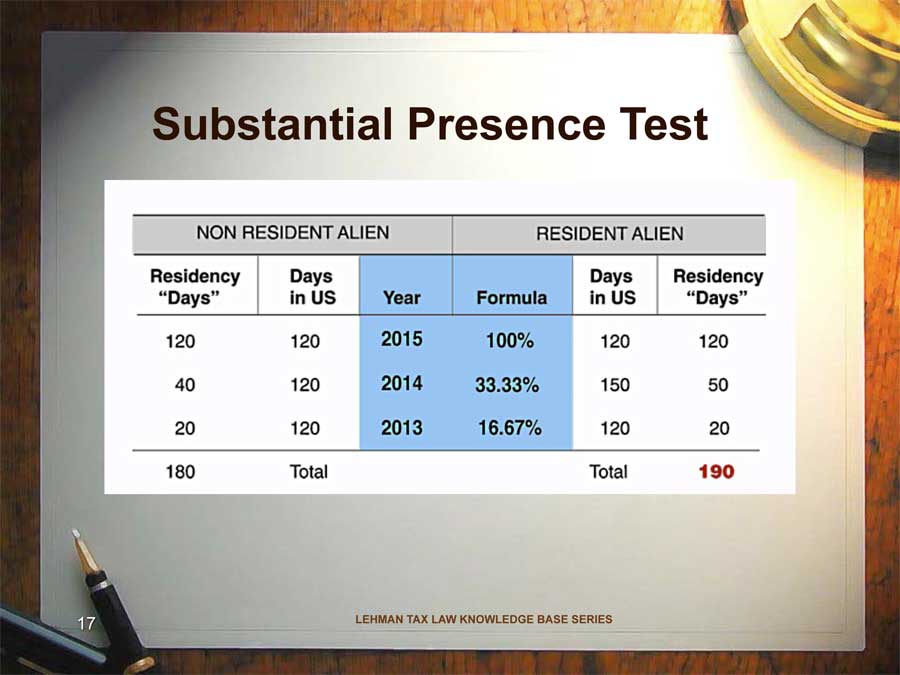

- Residency and tax consequences

- Pre-immigration planning goals

- Avoiding anti-deferral rules

- Minimizing transfer tax impact

- EB-5 visa program and tax considerations

- EB-5 and New Markets Tax Credits

- Covered expatriates and the “eight-year rule”

Speakers:

Richard S. Lehman, Attorney, United States Taxation and Immigration Law, Boca Raton, Fla.

Mr. Lehman’s tax law practice focuses on an array of commercial transactions involving an international and domestic client base. He previously served as Senior Attorney, Interpretative Division, Chief Counsel’s Office, Internal Revenue Service, Washington D.C. He authored articles on taxation and was editor and contributing author of A Guide to Florida International Business and Investment Opportunities.

Larry J. Behar, Esq., Managing Partner, Behar Law Group, Ft. Lauderdale, Fla.

Mr. Behar specializes in solving complex immigration issues generating business immigration solutions when representing entrepreneurs, investors, multinational companies, professionals and completes family reunification. He published two books in multiple languages, How to Immigrate to U.S.A. and EB-5 United States Immigration through Investment.

Leave a Reply