Estate Planning in a Low-Interest Environment

By Richard S. Lehman, Esq., of Richard S. Lehman P.A.; Boca Raton, FL

In times of low interest rates, special opportunities arise for estate planning. It is of the utmost importance that all people look at their portfolios and consider various strategies for maximizing their wealth for current and future family generations.

Most are aware of the more common tax-planning tools, such as various exclusions — for example, each person’s right to give $11,000 annually, free of gift tax, to each of any number of beneficiaries; and the right to transfer, during a lifetime, $1.5 million free of estate tax and $1 million free of gift taxes. Fewer people, however, are aware of the more sophisticated estate-planning tools that are used generally by the very wealthy in these economic times but have for years been available to all.

With that in mind, the following are several summarized tax-planning tactics that should be considered and discussed with your team of financial-planning experts.

Transfer with Retained Interests

The first estate-planning technique that accomplishes several tax purposes at the same time is known as a Transfer with Retained Interests, designed to transfer assets out of one’s estate that are likely to greatly appreciate in value in future years. Properly used, the technique should insure that the increase in value after the lifetime transfer of an asset is no longer included in one’s estate for estate tax purposes. The technique also can result in completing transfers of assets to one’s children, grandchildren and other beneficiaries at highly reduced gift tax costs.

Many of these transfers also generally insure some degree of continued control, permitting the transferor to retain a good deal of the economic benefits of assets he or she transfers. This technique is extremely valuable when interest rates are low, such as now.

Grantor Retained Annuity Trust

One of the most effective strategies in today’s low-interest-rate climate involves establishing a Grantor Retained Annuity Trust. The following are several features:

- The original owner of the asset and creator of the trust, the Grantor, transfers an appreciating asset to an irrevocable trust and the Grantor continues to retain all or a portion of the trust’s income for his or her life or for a period of years (the “Term”).

- At the end of the term of the annuity, the asset (the “Remainder Interest”) will pass to the Grantor’s beneficiaries. Assume that the asset will increase in value. By making a gift of the Remainder Interest, any increase in the value of the asset will pass to the beneficiary without being taxed in the Grantor’s estate. Equally as important, by making a gift only of the Remainder Interest and not of the entire ownership of the asset, the valuation of the gift, for gift tax purposes, is greatly reduced because there is a delay in the beneficiaries’ enjoyment of the gift during the Term.

To understand why the Grantor Retained Annuity Trust is beneficial at low interest rates, assume the following:

- The Grantor establishes an Irrevocable Trust for his children and transfers an asset worth $1 million that will pay an income of 6 percent per year and will double in value in 10 years.

- The Grantor retains an interest in all of the trust’s income for 10 years at $60,000 per year, consuming all the trust income annually.

- At the end of the 10-year period, the Grantor’s beneficiaries own the asset.

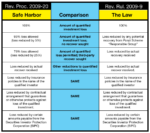

To determine the value of the taxable gift of the Remainder Interest the IRS uses a fixed formula tied directly to the prevailing interest rates. This formula applies to all transactions and does not take into account the actual income produced by an asset in trust. Since the interest rates are so low today, the IRS uses a valuation formula that assumes the Irrevocable Trust will provide an annual return of only 4.2 percent, or $42,000 per year. However, the Irrevocable Trust earns $60,000 per year, to be paid to the Grantor.

The IRS rule assumes that the Trust will produce only $42,000 in income. The IRS formula to determine the value of the Remainder Interest also assumes that the balance of the $60,000 to be paid to the Grantor, equal to $18,000 per year, must be taken from the Irrevocable Trust’s $1,000,000 principal each year.

Even though the Irrevocable Trust provides $60,000 a year in income, under these IRS assumptions the value of the taxable gift of the Remainder Interest that the Grantor has given the children 10 years from now is reduced (1) to reflect that the gift will not be received for a period of 10 years, and (2) because of this presumed invasion of principal, equal to $18,000 annually.

Thus, for gift tax purposes, the Remainder Interest will pass to the children when the term of the annuity ends in 10 years and it will be valued as a small percent of the Trust’s value, subject to only a small gift tax at the time of the gift. When the term ends after 10 years, the asset may continue to be held in trust for the children’s benefit.

Assuming the facts above, the IRS formula says that the gift now of the Remainder Interest to the children of this $1 million asset is a taxable gift equal to only $518,158. The asset is transferred to an Irrevocable Trust at a value, for gift tax purposes, of $518,158. At the end of the Grantor’s annuity term, the appreciated asset, with a value of $2 million, will pass free of any additional gift or estate tax, since it was all given as a gift 10 years ago. At a 48 percent estate or gift tax rate, there has been a savings of $740,921 in taxes, calculated as follows:

- Property Value at Termination of Annuity $2,000,000

- Taxable Gift — Present Value of Remainder ( 518,158)

- Tax-Free Portion of Gift to Children $1,481,842

- Potential Estate Tax Savings @ 48% $711,284

There are, however, certain disadvantages of utilizing the Grantor Retained Annuity Trust. Most important of all, if you die during the term of the annuity, the value of the asset or some portion thereof will be included in your estate for estate tax purposes, and none or only a portion of the tax benefits sought by using a Grantor Retained Annuity Trust will result.

Several techniques have been developed that will ameliorate the consequences of dying during the term of the annuity.

Charitable Lead Trust

A Charitable Lead Trust can provide a long-term economic advantage to the Grantor of the Trust. It can accomplish these tax and economic benefits while permitting the Grantor to endow charitable causes. The Charitable Lead Trust is used generally to leave appreciating assets to one’s beneficiaries at significantly reduced estate and gift tax rates, the way the Grantor Retained Annuity Trust does. The Charitable Lead Trust also has special tax advantages in the current climate of low interest rates.

A Charitable Lead Trust is formed by contributing an asset to a trust that pays income to qualified charities for a number of years, after which time the charity’s rights to the income cease and the property is owned by the Grantor’s beneficiaries.

Like the Grantor Retained Annuity Trust, the principal advantage of a Charitable Lead Trust is that it permits a donor to give a Remainder Interest in property to a family member while paying little or no gift or estate tax. Generally, the Grantor does not receive an income tax charitable deduction. However, the income of the Charitable Lead Trust is not included in the donor’s income if it is paid to the charitable beneficiary. Furthermore, the donor will receive a gift tax deduction for the value of the charity’s interest.

The Charitable Lead Trust works best with an asset that will appreciate significantly, since the appreciation in value of the trust principal, which ultimately will belong to the beneficiaries as outright owners, will pass free of estate and gift tax.

Valuation Reductions

A tax-planning concept not necessarily related to low interest rates is the technique of assuring the lowest value for tax purposes of any asset transferred by you to a beneficiary, either as a sale, as a gift (gift tax) or at death (estate tax). The gift and estate taxes are both taxes on the transfer of wealth and are measured by the value of the transferred asset. An asset that can be transferred at a legally lower value rather than higher value can result in a substantial saving.

One example of this can be found in the dual ownership of an asset. A piece of real estate (the “Real Estate”) owned equally by two people as tenants in common might have a sale value of $1 million. However, because each owner owns only 50 percent of the Real Estate, the value of each owner’s separate interest is reduced (for estate and gift tax purposes) to a value that is less than one half of the Real Estate’s full appraised fair market value.

This is because each owner’s 50 percent interest has impediments that affect its value. A buyer for one owner’s share would have to deal with the second owner’s desires for the Real Estate that may be different from those of the potential buyer. The market for a buyer at the full value of the Real Estate is going to be reduced when the seller is selling only partial and not total ownership of an asset.

The Internal Revenue Code recognizes this practicality and for gift or estate tax purposes provides for a “valuation reduction” for the impediments of partial interests. For gift tax purposes, the value of a gift of the 50 percent ownership interest might be only $300,000

A more sophisticated version of obtaining a valuation deduction is the use of an entity known as the Family Limited Partnership (the “Partnership”). A family asset such as the Real Estate can be contributed to the Partnership that is owned and controlled by the contributor and/or the contributor’s family, with family members having differing voting and economic interests in the Partnership. Once the Real Estate is owned by the Partnership, each of the family members then owns a partial interest in the Partnership and will not directly own the Real Estate.

Therefore, a gift of 50 percent interest in a Partnership that owns a $1 million piece of Real Estate may be a gift valued at $300,000 and not $500,000.

The Partnership (or a Limited Liability Company) is often the preferred method of transferring partial ownership interests. This is because not only does it achieve the estate or gift tax valuation reduction but it also accomplishes many other aims. The Partnership provides the transferor with a method of continuing to control and benefit economically from the assets without assuming any personal liability.

In addition, the Partnership provides for significant asset protection for its partners, making it more difficult for creditors of the owner to gain control of the full value of Partnership assets. A discussion of the Partnership’s asset-protection qualities, however, is beyond the scope of this article.

Private Foundation

A completely different estate-planning tool is forming a Private Charitable Foundation (the “Foundation”).

This technique does not allow one to leave more property to heirs and beneficiaries at lower tax rates. It does, however, permit a person to create a lasting charitable legacy that the person and the person’s family continue to control and finance with funds that are deductible for income and estate tax purposes. In addition to accomplishing this charitable purpose, the Foundation can provide an income stream to beneficiaries in the form of board member compensation.

A charitable foundation is generally formed as a non-profit corporation that has a board of directors or trustees and officers. The Foundation can be established during a person’s life, and at the person’s death the Foundation is subject to a set of compliance rules to insure that its funds are being distributed and used for charitable purposes.

This article is intended to make high-net-worth individuals aware of a variety of strategies to preserve assets and limit tax liability. Keep in mind that these strategies are complex and should never be implemented without the assistance and guidance of an attorney.

Richard S. Lehman is a principal in the Boca Raton-based law firm of Richard S. Lehman and Associates, P.A. The firm specializes in tax law, estate and asset protection planning, and international law.