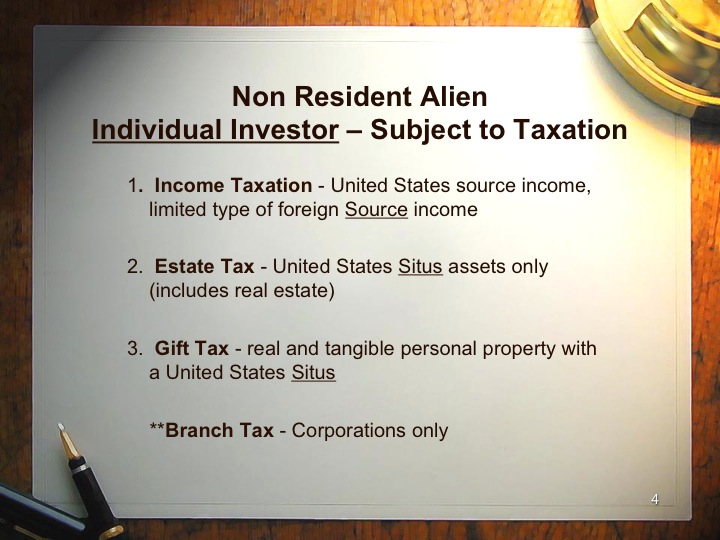

Tax Planning for Foreign Investors Acquiring Smaller ($500,000 and under) United States Real Estate Investments

. . .U.S. estate taxes may be completely avoided if the individual foreign investor owns a foreign corporation that may in turn own the U.S. real estate.