Tax Planning and Foreign Investors in United States Real Estate

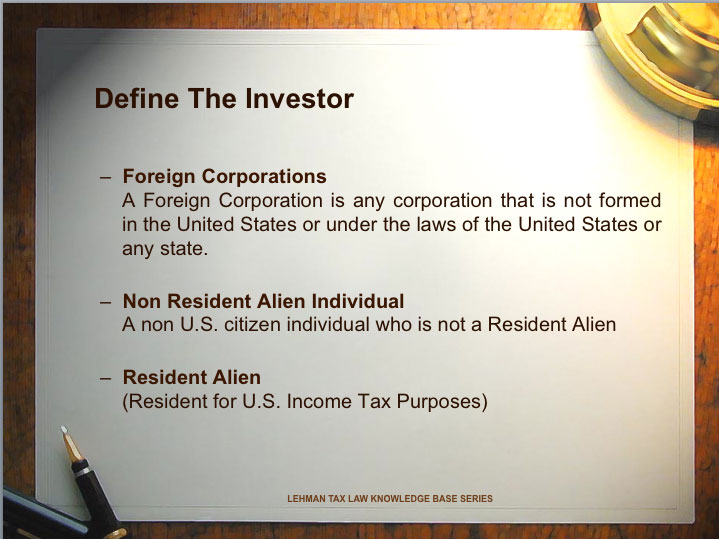

The object of this video is to provide professional advisors and foreign real estate investors with an understanding of the United States taxation of foreign investments in United States real estate, and the numerous strategies that can be used to …

Tax Planning and Foreign Investors in United States Real Estate Read more »