An update on the IRS Streamline Compliance Program

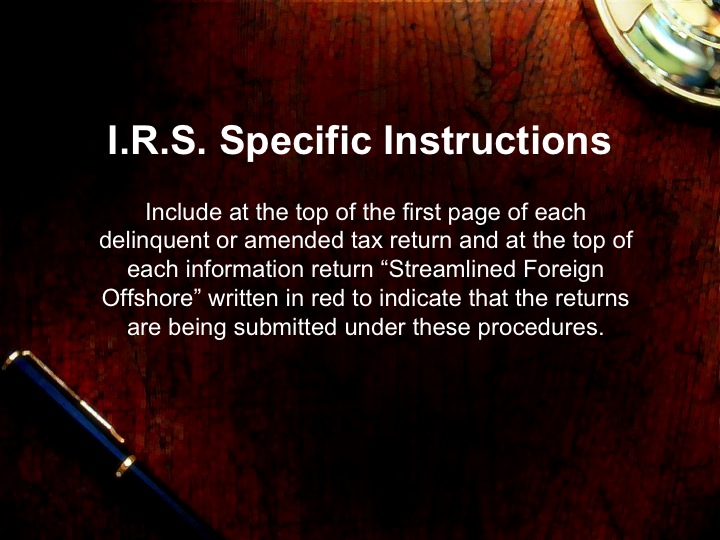

There also is an Internal Revenue Service program that permits United States individuals, who have innocently and unknowingly not reported their foreign bank deposits, to report those deposits at a much reduced penalty than the penalty applicable to the willful …

An update on the IRS Streamline Compliance Program Read more »