Tax Planning for Foreign Investors Acquiring Larger (One Million Dollars and over) United States Real Estate Investments

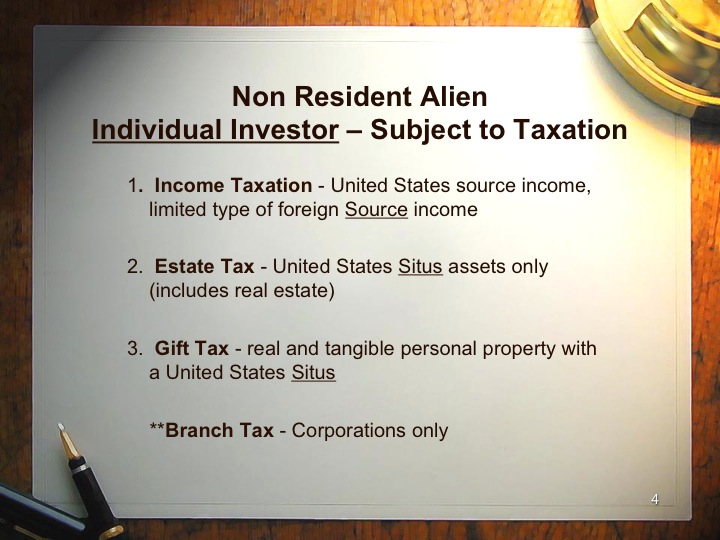

This is principally an article about tax planning for the non resident alien individual and foreign corporate investor that is planning for larger size investments in United States real estate (“Foreign Investor”). That is investments of One Million Dollars ($1,000,000) …