IRS Streamlined Compliance Filing Procedure

‹ Return to U.S. Taxpayers residing outside the United States and the Streamlined Procedures

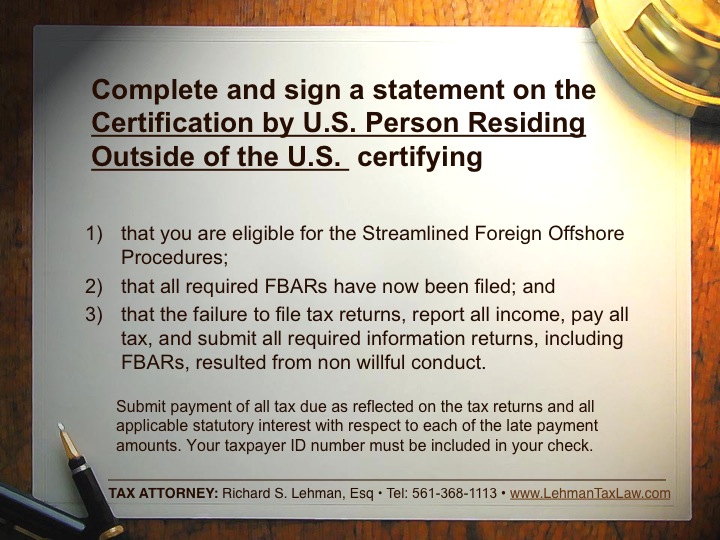

a taxpayer who wishes to be in the Streamlined Program must not have willfully failed to report income from any foreign asset

Leave a Reply